Capital One Hit With Massive Lawsuit Alleging Customer Cheating Scheme

Background

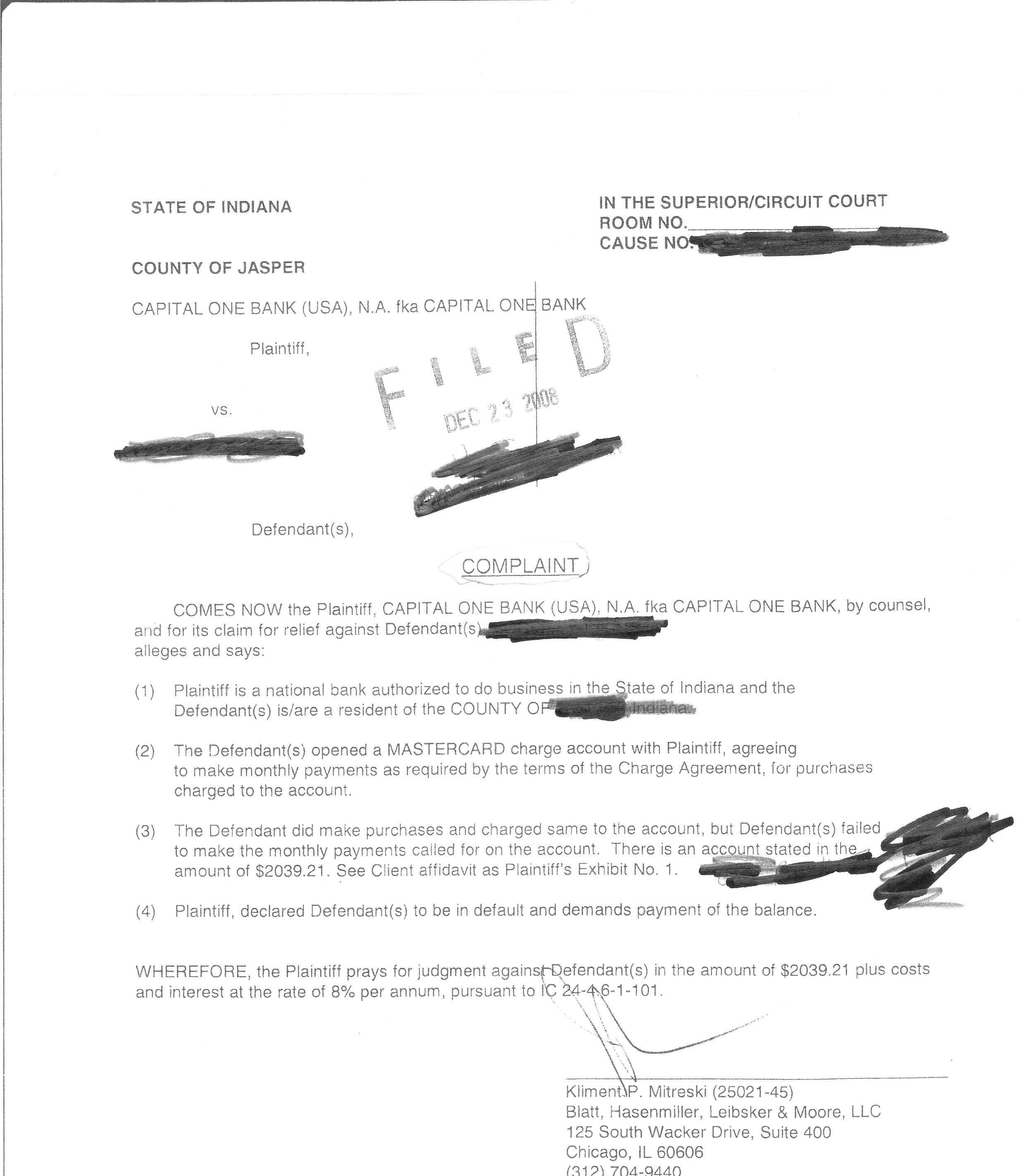

Capital One Financial Corporation, one of America's largest banks, has been hit with a massive lawsuit alleging that it engaged in a years-long scheme to defraud customers. The lawsuit, filed by the Consumer Financial Protection Bureau (CFPB), alleges that Capital One systematically cheated customers by charging them hidden fees, misrepresenting interest rates, and illegally foreclosing on their homes.

Details of the Allegations

The CFPB's lawsuit alleges that Capital One engaged in a wide range of deceptive practices that caused significant financial harm to its customers. These practices include:

- Charging hidden fees and inflated interest rates on credit cards

- Misrepresenting the terms of mortgage loans

- Illegally foreclosing on homes

- Failing to provide customers with clear and accurate information about their accounts

The CFPB alleges that Capital One's deceptive practices caused billions of dollars in losses to its customers. In some cases, customers lost their homes or were forced into bankruptcy due to Capital One's illegal activities.

Capital One's Response

Capital One has denied the allegations in the CFPB's lawsuit. The bank has stated that it is committed to treating its customers fairly and that it will vigorously defend itself against the allegations.

Legal Experts' Perspectives

Legal experts say that the CFPB's lawsuit against Capital One is a significant development in the fight against financial fraud. The lawsuit alleges that Capital One engaged in a systematic pattern of deception that caused significant harm to its customers.

Experts say that the lawsuit could have a major impact on the banking industry. If Capital One is found liable, it could face billions of dollars in penalties and fines. The lawsuit could also lead to increased scrutiny of other banks and financial institutions.

Consumer Advocates' Perspectives

Consumer advocates say that the CFPB's lawsuit against Capital One is a victory for consumers. The lawsuit sends a strong message that banks will be held accountable for cheating their customers.

Advocates say that the lawsuit should also lead to increased protection for consumers. The CFPB is seeking to obtain a court order that will require Capital One to change its practices and provide compensation to its customers.

Implications for Consumers

The CFPB's lawsuit against Capital One has important implications for consumers. The lawsuit shows that consumers should be wary of deceptive practices by banks and other financial institutions.

Consumers should carefully review their credit card agreements and mortgage documents before signing up for any new accounts. Consumers should also be aware of their rights and responsibilities under the law.

Conclusion

The CFPB's lawsuit against Capital One is a major development in the fight against financial fraud. The lawsuit alleges that Capital One engaged in a systematic pattern of deception that caused significant harm to its customers.

The lawsuit could have a major impact on the banking industry. If Capital One is found liable, it could face billions of dollars in penalties and fines. The lawsuit could also lead to increased scrutiny of other banks and financial institutions.

Consumers should be aware of the risks of deceptive practices by banks and other financial institutions. Consumers should carefully review their credit card agreements and mortgage documents before signing up for any new accounts.

Read also:

Santos Vs America LIVE Score Updates: Evenly Matched Game, Both Looking For (0-0)

Henry Soared To New Heights In Ravens' Triumphant Win

Nick Mosby Asks President Biden To Pardon His Ex